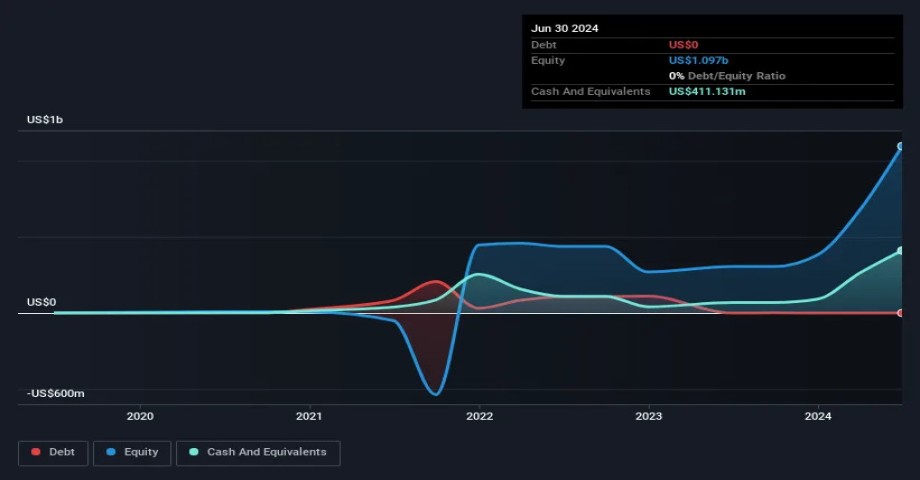

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. Indeed, Iris Energy (NASDAQ:IREN) stock is up 146% in the last year, providing strong gains for shareholders. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.So notwithstanding the buoyant share price, we think it's well worth asking whether Iris Energy's cash burn is too risky. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). First, we'll determine its cash runway by comparing its cash burn with its cash reserves.javascript:nicTemp();How Long Is Iris Energy's Cash Runway?A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. As at June 2024, Iris Energy had cash of US$411m and no debt. Looking at the last year, the company burnt through US$427m. So it had a cash runway of approximately 12 months from June 2024. Notably, analysts forecast that Iris Energy will break even (at a free cash flow level) in about 17 months. That means it doesn't have a great deal of breathing room, but it shouldn't really need more cash, considering that cash burn should be continually reducing. The image below shows how its cash balance has been changing over the last few years.How Well Is Iris Energy Growing?It was quite stunning to see that Iris Energy increased its cash burn by 288% over the last year. Of course, the truly verdant revenue growth of 148% in that time may well justify the growth spend. In light of the data above, we're fairly sanguine about the business growth trajectory. Clearly, however, the crucial factor is whether the company will grow its business going forward.How Easily Can Iris Energy Raise Cash?Given the trajectory of Iris Energy's cash burn, many investors will already be thinking about how it might raise more cash in the future. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).Iris Energy has a market capitalisation of US$1.6b and burnt through US$427m last year, which is 27% of the company's market value. That's not insignificant, and if the company had to sell enough shares to fund another year's growth at the current share price, you'd likely witness fairly costly dilution.Is Iris Energy's Cash Burn A Worry?Even though its increasing cash burn makes us a little nervous, we are compelled to mention that we thought Iris Energy's revenue growth was relatively promising. There's no doubt that shareholders can take a lot of heart from the fact that analysts are forecasting it will reach breakeven before too long. Cash burning companies are always on the riskier side of things, but after considering all of the factors discussed in this short piece, we're not too worried about its rate of cash burn.